Our financial industry, government, and academics, unfortunately, seriously lack a scientific understanding of how the capital market movement has led to financial crises.

IBMetrics' research captures market bull-bear behavior sentiment as a validation signal for investors to understand the current market emotion

For IBMetrics Bull/Bear Indicator licensing agreement inquiries, please contact us here.

The Science behind Market Cycle, Momentum, and Investor Psychology

|

Dr. Charlie Yang's presentation is now available for download:

CAPITAL MARKET CRISIS & ECONOMIC TREND PREDICTABILITY |

| ||||||

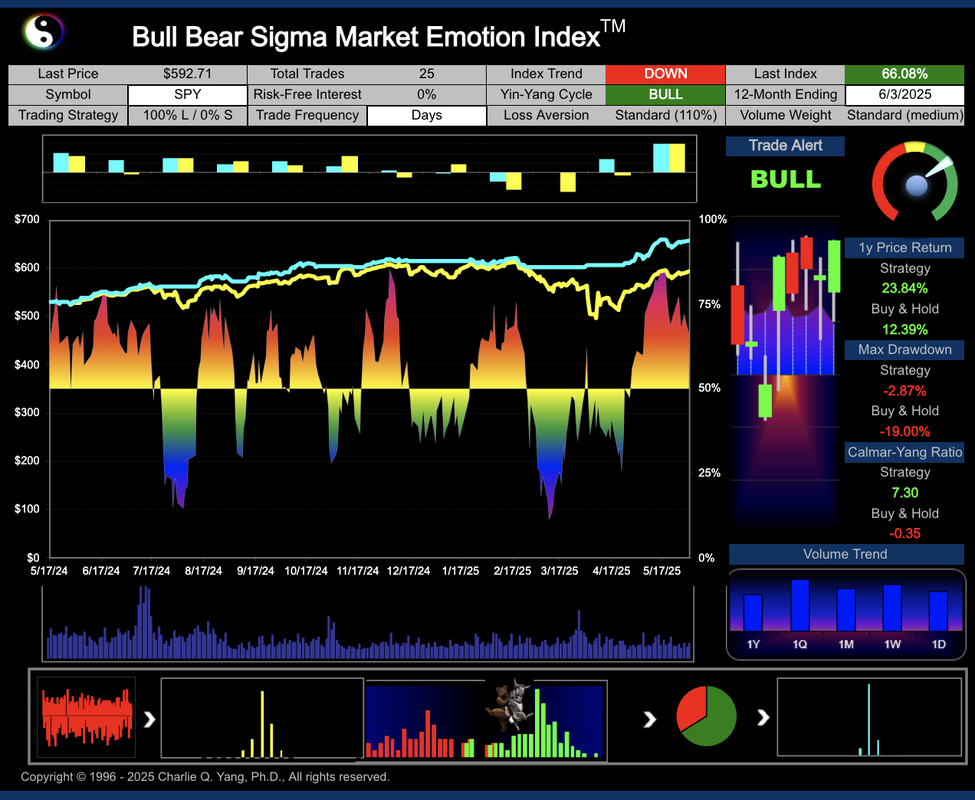

US Short-Term Market Emotion Index

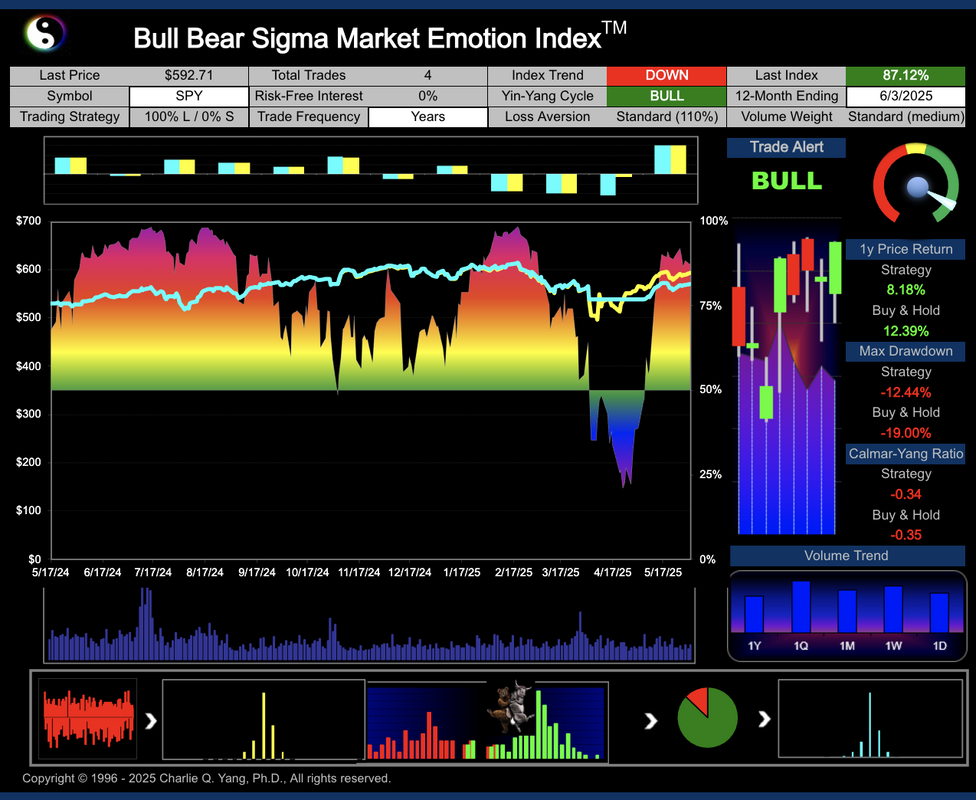

US Long-Term Market Emotion Index

S&P 500 Heatmap (source: Stock Analysis)

To inquire about a free demo for any stock/ETF measured by the IBMetrics Stock Emotion Machine, please make your request to cqyang@afiea.com or via LinkedIn.

|

Download ISIR Machine User Manual here:

|

| ||||||

|

Welcome to IBMetrics. My name is Charlie Yang. I am the editor of IBMetrics and a researcher dedicated to discovering scientific measures to understand the factors driving the capital market and their impact on personal investment, economy, and government policy.

Here you will find the up-to-date information about several most important investor behavior measures to help you understand how the stock market changes in the short and long terms.

|

My three decades of stock market research leads me to believe that there are four main forces driving the stock market prices:

- Fundamentals - Earning and Revenue Growth

- Interest Environment - Federal Reserve Monetary Policy

- Investor Confidence - Consumer Spending

- Institutional Investor Behavior - Big Money Flow

- Earning and revenue growth, both actual and expected figures, drive investors to put more money into companies with better fundamentals.

- Federal Reserve's actions on interest drive investor actions to move money between the risk-free asset and the stock market for better risk-optimized outcomes.

- Investor confidence drives spending that affects future company earnings and revenue. Confidence, often triggered by short-term events, also changes investors' willingness to take more or fewer risks.

- Finally, institutional investors such as pension and hedge fund managers control the most asset in the capital market. Their money flow can be triggered by rebalancing, changing objectives, and outlook.

The above four factors are all determined by investors' views and actions that drive the stock market movement. How can investor behavior be measured? Here you will find the up-to-date information about a few major investor sentiment measures, including the BB-Sigma Index.

I created the BB-Sigma Index in mid-1990's as a validation tool for the Capital Market Behavioral Theory which I developed over the last 30 years. The reading of BB-Sigma Index indicates the percentage of all traders showing bullish attitude on the market. It is calculated as the statistical sum of all bulls and bears trading actions. It is an indicator solely based on intra-day market trading actions.

The stock market trend reversal happens when the overall bullish force overtakes the overall bear force in controlling the market direction, or vice versa. Fundamentally, the BB-Sigma Index detects the sentiment changes during the different phases of money flows (see chart below), from Smart Money actions happening at the beginning of the Stealth Phase (buy) to the end of Mania Phase (sell). It has been time-tested as the most reliable price trend indicator for any tradable securities. Please contact me for further research and advisory inquiries.

Further Readings: The Misery Index

I developed the BB-Sigma Index to better capture the stock market investor behaviors as a leading macroeconomic indicator. One other interesting indicator as a reference is the Misery Index.

The Misery Index is an economic indicator, created by economist Arthur Okun. The index helps determine how the average citizen is doing economically and it is calculated by adding the seasonally adjusted unemployment rate to the annual inflation rate. It is assumed that both a higher rate of unemployment and a worsening of inflation create economic and social costs for a country.

Harvard Economist Robert Barro created what he dubbed the "Barro Misery Index" (BMI), in 1999. The BMI takes the sum of the inflation and unemployment rates, and adds to that the interest rate, plus (minus) the shortfall (surplus) between the actual and trend rate of GDP growth.

In the late 2000s, Johns Hopkins economist Steve Hanke built upon Barro's misery index and began applying it to countries beyond the United States. His modified misery index is the sum of the interest, inflation, and unemployment rates, minus the year-over-year percent change in per-capita GDP growth.

|

Disclaimers: IBMetrics' ongoing research results, statements, and statistics are believed to be reliable but are not guaranteed as to accuracy, timeliness, or completeness. We do not endorse, recommend, or comment any specific financial firms and/or their products or services. The past performance cannot guarantee its future performance. You bear full responsibility for own investment decisions which may be influenced by research or information published on this site. You also agree that our content source publishers will not be liable for any investment decision made or action taken by you.

|

Copyright: All Information available through this site is protected by copyright and intellectual property laws. All rights are reserved by the information source providers. You may not reproduce, re-transmit, disseminate, sell, publish, broadcast, nor shall the Information be used in connection with creating, promoting, trading, marketing investment products without the express written consent of the source providers. You are entitled to use the Information it contains for your private, non-commercial use only.

Systematic Investment Research and Education since 1997

|

© AFIEA.com. All rights reserved.

Capital Market Behavioral Finance Research since 1996

Capital Market Behavioral Finance Research since 1996